WhatsApp Business for Banking: A Complete Guide

In recent years conversational banking has become the new way banks and fintech businesses manage a great deal of their customer support. In this landscape, leveraging a WhatsApp chatbot for banking has emerged as a winning strategy.

This approach allows financial institutions to offer instant, personalized customer service directly through one of the world’s most popular messaging platforms. By integrating a WhatsApp chatbot into their service model, banks can streamline customer interactions and enhance customer satisfaction and engagement.

Role of WhatsApp Business in Banking

In banking, chatbots are now integral in providing round-the-clock support, handling queries, and even assisting in transactions. Their ability to offer quick, efficient, and personalized responses has made them a cornerstone of modern banking customer service.

In addition to the chatbot functionalities, an exciting aspect of WhatsApp’s role in banking is WhatsApp Pay. For banks, incorporating WhatsApp Pay into their digital services can significantly enhance the customer experience by providing a fast, secure, and convenient method for sending and receiving money through the app. Money transfers are available only in India and Brazil for now.

WhatsApp, with its vast global user base, presents a unique platform for banks. By tapping into WhatsApp, you can reach customers on an app they use daily, offering convenience and familiarity.

Using WhatsApp in Banking has the potential to elevate the customer experience by providing services like account inquiries, transaction updates, fraud alerts, and financial advice directly through the app. This seamless integration can lead to higher customer satisfaction and loyalty.

Let’s delve into how chatbots navigate the complex landscape of banking regulations to ensure safe and compliant customer interactions.

Chatbots in Banking: Compliance & Security

Safety and privacy are common concerns for banks. WhatsApp conversations are end-to-end encrypted, meaning nobody, not even WhatsApp or its parent company, Meta, can read your customer communications.

When it comes to GDPR, there are a few things you can do to be compliant:

Obtain opt-in from your customers

WhatsApp strongly recommends businesses to receive consent from their customers that explicitly mention they wish to receive messages from your business on WhatsApp. To be GDPR-compliant, businesses must obtain opt-ins before messaging customers too.

Inform customers about data handling

You must tell your customers about the following:

- Your organization’s liable personnel for data protection

- The purpose of storing their information

- How long will you store their data

Enable Access and Deletion Requests

Your customers must be able to get a copy of their personal data and supplementary information. Moreover, it must be possible to erase their data if they request it.

Setting Up a WhatsApp Chatbot for Banking

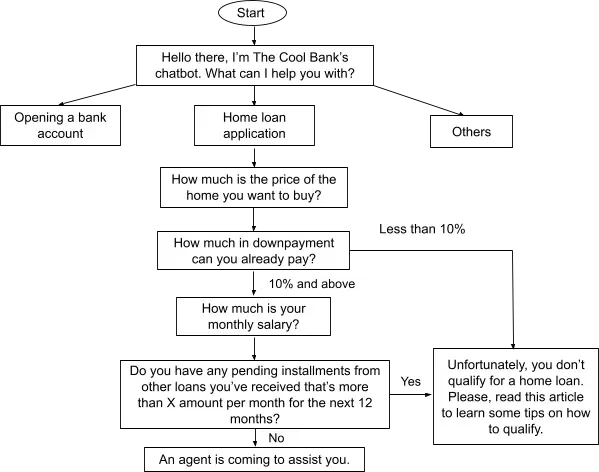

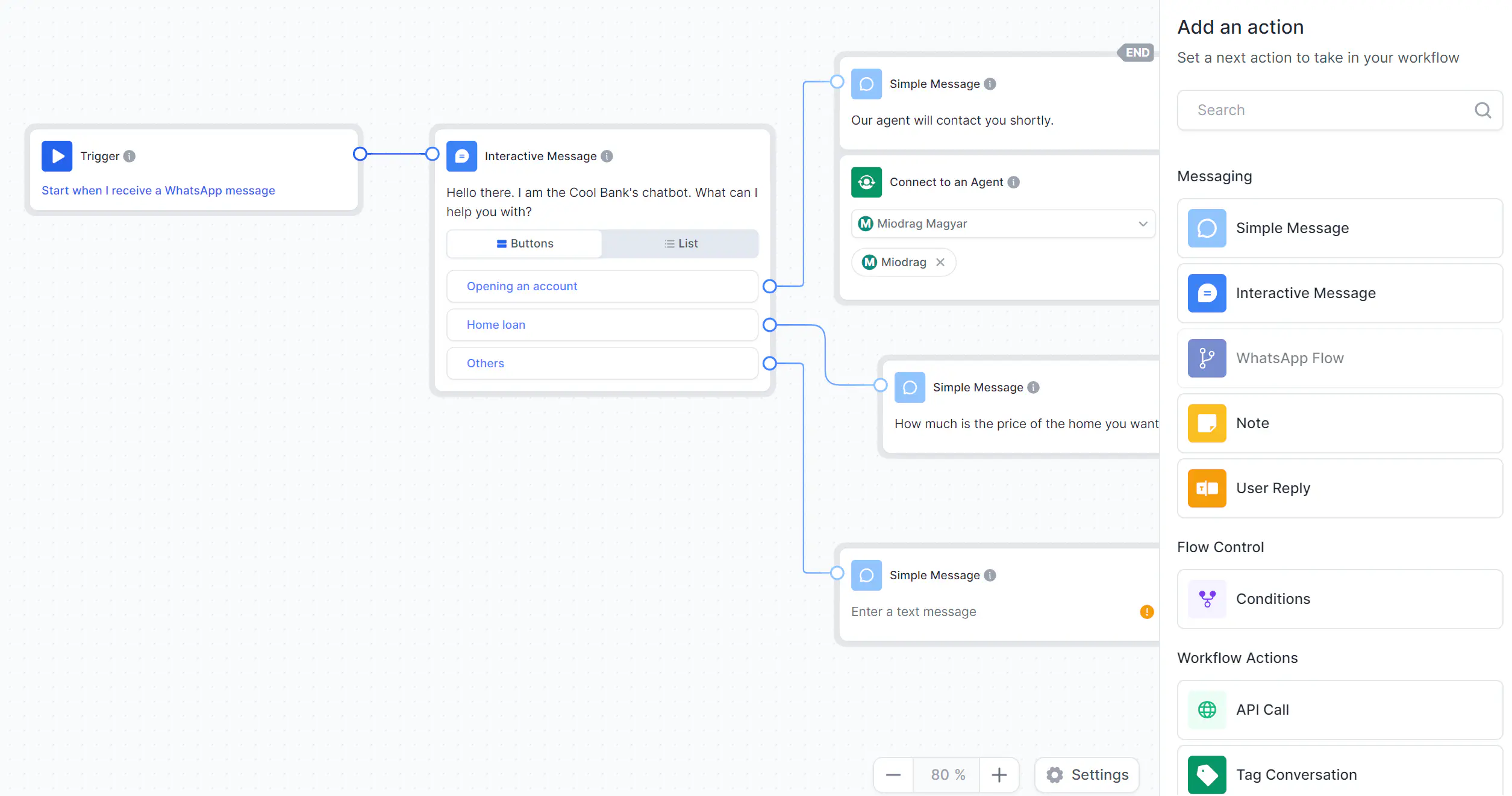

Let’s say your bank is looking to enhance its customer service and lead qualification process for home loans. To achieve this, you’d need to:

- Qualify Leads for Home Loans

- Develop a Regulation-Compliant Flowchart

By integrating a chatbot into the loan qualification process, you can efficiently manage initial borrower interactions, ensuring that only qualified leads are forwarded to your agents.

In our recent post, WhatsApp Chatbots: What Are They & How To Create One, you can learn everything you need to know to build a chatbot flow.

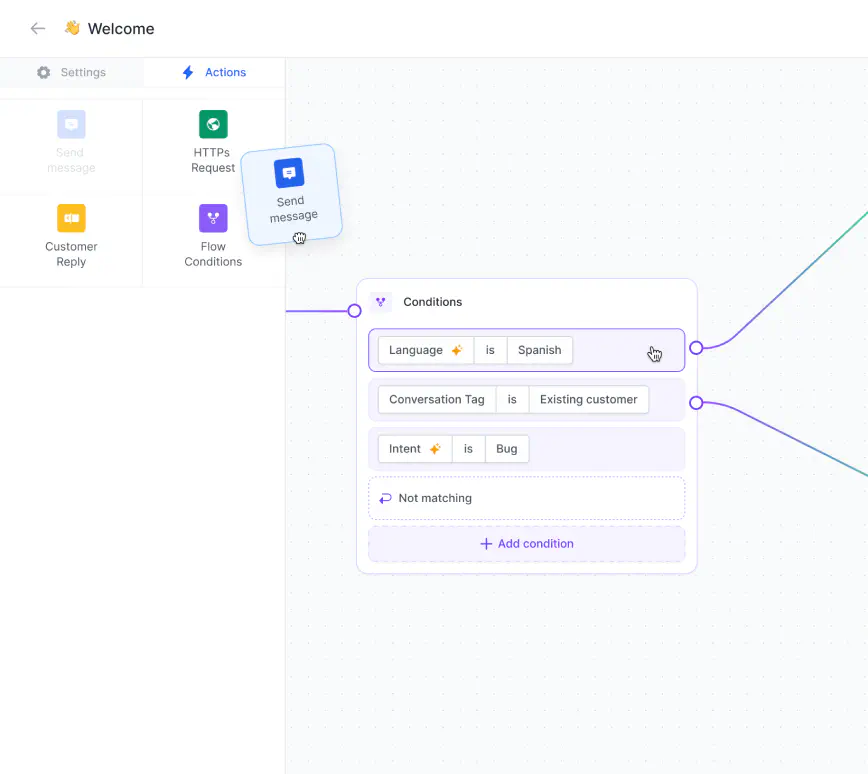

When considering how to create a WhatsApp chatbot for your bank, you have two options to choose from:

- Create it from scratch - if you are a technical person or have a tech team.

- Build a WhatsApp chatbot in minutes using a drag-and-drop chatbot builder like Rasayel.

Want to try Rasayel’s Chatbot builder for free? Sign up here!

Once you create your bot, you need to test it internally to see if it works smoothly (Step 4).

Then, you can release it and monitor it closely to see whether it’s working as you expect it to. Every month, have a look at a sample of 10% of your customer inquiries that the bot has handled. Did it handle them efficiently? Did the customers get their questions answered? Do they tend to exit the flow at some point without getting their answer? If yes, then you’d need to change something about your bot.

Using a WhatsApp bot for your business is an iterative process that needs constant improvement. Creating the perfect bot will take some time, but it’s worth it.

Benefits of Using a WhatsApp Bot in a Bank

24//7 Customer Support

Customers can reach your business any time of the day and resolve their pains with a WhatsApp chatbot. This is especially helpful for anything that needs quick action, such as blocking an account in case of debit card theft.

Quick Responses

With a bot, you can handle unlimited customer inquiries simultaneously. Customers don’t need to stay on the phone for long to speak with a customer support agent. There is no need to wait in long lines and fill up lengthy forms. Everything is at the tips of their fingers.

Better Efficiency & Lower Cost

Many standardized, repetitive processes can be automated with a WhatsApp chatbot. This way, you free up some time for your team members. Instead, they focus on activities that require human intervention and personalized service.

Higher Conversion Rate

Your bank can simultaneously handle unlimited customer inquiries with a WhatsApp chatbot. This means customers don’t need to wait long and your bot could guide them from the first touchpoint until they make a purchase. In other words, your WhatsApp bot increases your conversion rate.

How to Use WhatsApp Chatbots in Banking

Banks have been implementing chatbots in their apps to help their customers self-serve. Customers can benefit from those chatbots in various ways, like getting payment reminders, retrieving transaction history, and many more.

But what about the potential customers who don’t have the bank’s app on their phones yet? How could they get their answers quickly? A WhatsApp chatbot is a perfect solution to this problem.

Organize Customer Service Inquiries

When people enter a bank, the first thing they do is stand in line and wait for their number to be called before they can meet a customer service agent.

A bot could do the same thing but better. Before assigning an agent, bots can gather information about the customer and build a profile. This will speed up the process and help find the most relevant person for the client’s needs.

Automate Lead Qualification

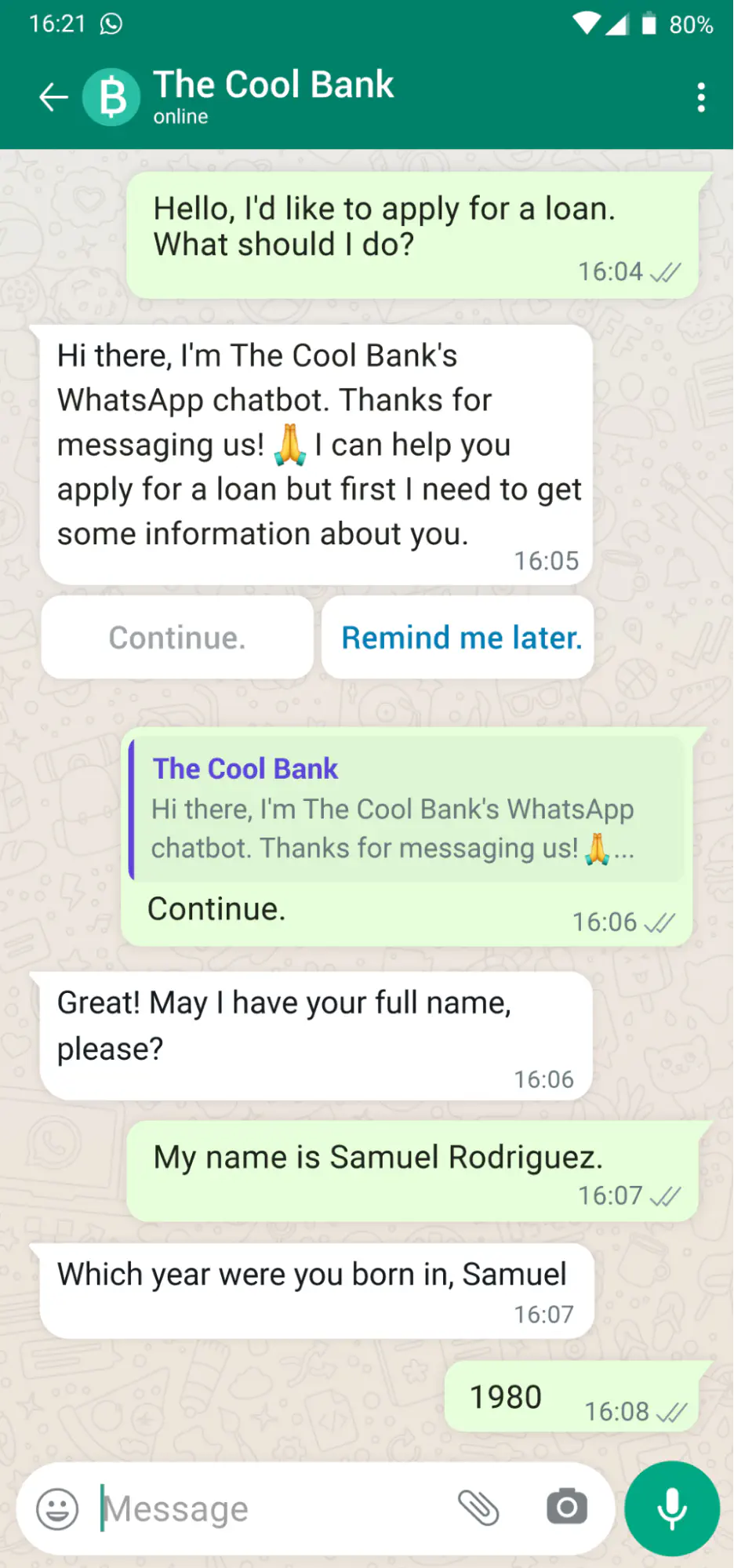

For things like loan qualification and insurance quotes, banks need to gather specific information about their prospects to see if they qualify. You can design a bot to ask prospects relevant questions and if they pass the first screening stage, an agent from your team could reach out to them for more specific qualification checks.

For example, if a potential lead is looking for a home loan, your bot could ask them about their age, salary history, desired home price, and credit history to see if they meet the prerequisites. If they do, then an agent from your team could guide them further.

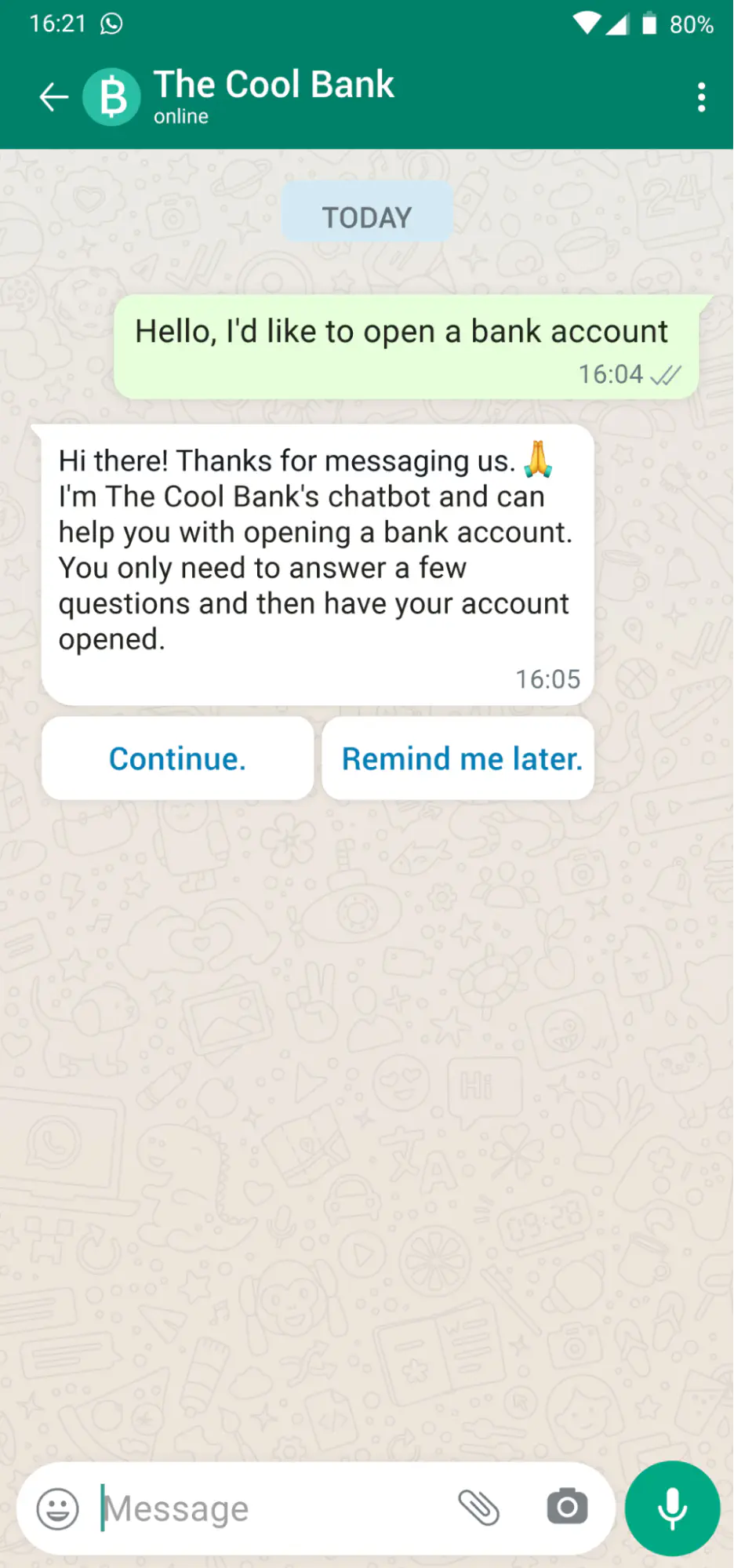

Facilitate Lead Generation

Customers can message your business on WhatsApp to get information on your products and services, and your chatbot can guide them. For example, they may want to open an account or purchase something. If it can’t do that, it refers them to an agent in your bank.

You could advertise your products and services via Facebook and Instagram ads with click-to-WhatsApp buttons. Once customers click on them, their WhatsApp app opens, and your chatbot can answer their questions or guide them step by step to become a customer.

With WhatsApp’s rich media capabilities, people can easily upload documents like ID cards and photos; therefore, banking services are made easy with WhatsApp.

Send Reminders & Notifications

A WhatsApp chatbot could remind customers of their upcoming payments and notify them about withdrawals and received payments. If there is any suspicious activity on their accounts, a bot could notify them and let them take quick actions such as blocking their debit card.

How to Get Started

Setting up a WhatsApp bot for your banking business is an exciting venture that can significantly enhance your customer service experience.

- Facebook Business Account

- Valid Phone Number

WhatsApp Business API Access: Gain access to the WhatsApp Business API or WhatsApp Cloud API.

CRM or Team Inbox: Since WhatsApp APIs do not have a built-in messaging interface, a team inbox for WhatsApp is essential for handling customer communications.

If you want to use Rasayel as your WhatsApp inbox and build a chatbot, you can use any of our plans.

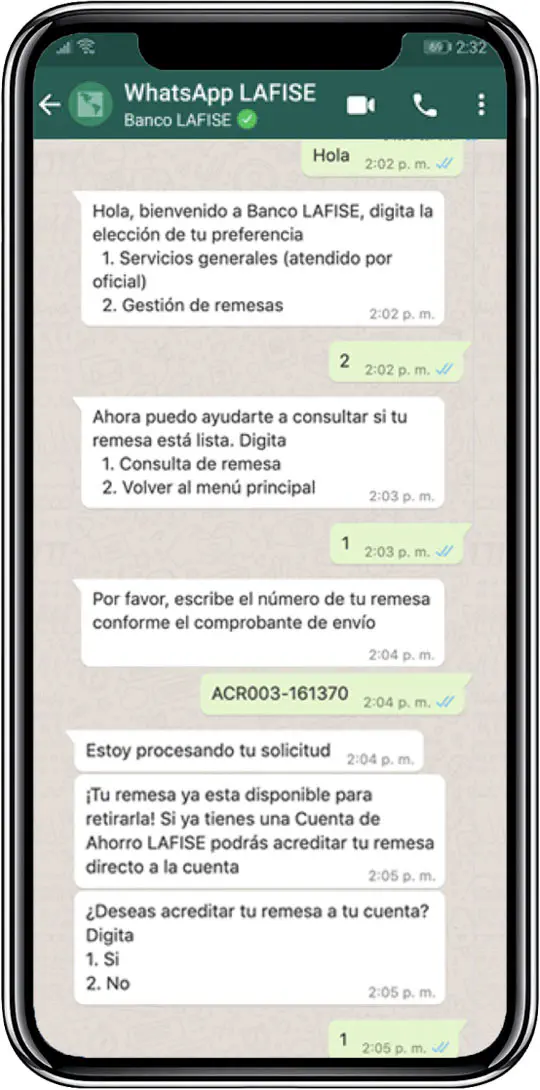

Success Story: How LAFISE Bank Uses a WhatsApp Chatbot for Banking

LAFISE Bank, a major financial institution in Latin America, effectively used a WhatsApp chatbot to enhance its banking services. The chatbot led to a 35% reduction in call center volumes, a 20% growth in new customers, and a remarkable increase in customer satisfaction.

Additionally, the bank expanded its services through WhatsApp, including new account openings and transaction processing, contributing to a 25% increase in new product sales.

Source: WhatsApp

The success of this digital tool in improving customer engagement and operational efficiency exemplifies the transformative potential of chatbots in the banking sector

Conclusion

The transformative potential of WhatsApp chatbots in the banking sector is undeniable. These advanced digital assistants offer banks and fintech companies the opportunity to revolutionize customer interactions, providing instant, personalized support on a platform widely used globally.

By deploying chatbots, banks can significantly enhance customer satisfaction, streamline operations, and introduce a new level of convenience and efficiency. Embracing this innovative approach is not just about technological advancement; it’s a strategic decision to elevate banking services and strengthen customer relationships in today’s digital era.

Frequently Asked Questions

WhatsApp can be used for banking by integrating a WhatsApp chatbot through the WhatsApp Business API. This chatbot can offer services like account inquiries, transaction updates, fraud alerts, and financial advice. Customers can interact with the chatbot for various banking needs, making banking more accessible and efficient.

The WhatsApp Business API is a platform that allows banks to integrate their systems with WhatsApp, enabling them to use chatbots for automated customer service. This API provides a secure and efficient way to handle customer interactions, streamline banking operations, and offer a range of services directly through the WhatsApp messaging platform.

A WhatsApp chatbot for banking is an automated messaging tool that uses artificial intelligence to communicate with customers via WhatsApp. It can handle inquiries, assist in transactions, and provide customer support services.

It offers 24/7 customer support, reduces response times, lowers operational costs, and improves customer satisfaction by providing quick and efficient service.

Yes, WhatsApp conversations are end-to-end encrypted, ensuring a high level of security for customer interactions. However, compliance with local regulations and data protection laws is crucial.

Yes, advanced chatbots can assist with basic transactions like checking balances, making payments, and processing transfers, depending on their programming and integration with the bank’s systems.

WhatsApp banking functions through a chatbot integrated with the bank’s system. Customers can interact with this chatbot using familiar WhatsApp features to check account balances, view recent transactions, receive notifications, and get answers to common banking queries. To set up a chatbot, you need a Facebook Business Account, a compliant phone number, access to WhatsApp Business API, and a CRM or team inbox. You can code a chatbot from scratch or use a chatbot builder platform.

Customers can interact with the chatbot by sending messages to the bank’s WhatsApp number. The chatbot responds with pre-set answers or information retrieved from the bank’s systems.

Learn more

If you'd like to learn more about how WhatsApp can help you grow your business, please reach out to us on WhatsApp at +13024070488 (Click to chat now).

We also offer a free consultation session where we review your use case, answer any questions about WhatsApp, and help you build a strategy to make the best out of the platform. Book a call with us here. We'd love to speak with you:

Book a call: Europe, the Middle East, and Africa

Book a call: LATAM

Curious about Rasayel? Schedule a demo today.

Miodrag is a seasoned WhatsApp marketing expert with over 15 years of experience in B2B sales and communication. Specializing in the use of WhatsApp Business API, he helps businesses use WhatsApp’s marketing features to grow their sales and improve customer engagement. As one of the early adopters of WhatsApp Business, Miodrag has a deep understanding of its tools and strategies, making him a trusted authority in the field. His insights have helped many businesses with their communication strategies to achieve measurable results.